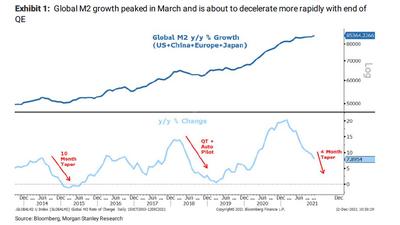

Until last week, the economic and market views of Goldman Sachs and Morgan Stanley couldn’t be more opposite: the former, delightfully optimistic, expects the US economy to grow on all cylinders in 2022 and despite the Fed’s tightening – two months ago Goldman flipped its Fed views by pulling forward its first rate hike forecast by one year to July, and followed it up over the weekend by predicting that liftoff will begin in May with two more rate hikes to follow in 2022…

… said in its year-ahead market forecast last month that it expects the S&P to hit 5,100 by the end of 2022 even as the economy slows down modestly from its current feverish pace.

Meanwhile, far less optimistic than their Goldman peers, Morgan Stanley’s economists expected – until late last week – the Fed to stand pat without hiking even once in 2022. That changed over the weekend, however, when the bank admitted “defeat” and now expects two rate hikes in 2022, even as the bank’s chief market economist Michael Wilson sees the S&P closing 2022 at 4,400, some 5% below current levels.

So while there has been some convergence on the economy and Fed front, a gaping divergence remains when it comes to what the two most influential US banks think the market will do, a schism which only became more acute in the past 24 hours, when on one hand Goldman predicted that a massive year-end Santa Rally is imminent (as we discussed last night), while Morgan Stanley doubled down on its bearish view this morning when in Michael Wilson’s latest strategy outlook piece (available to professional subscribers), he warns that “the Fed’s pivot to a more aggressive tapering schedule poses a larger risk for asset prices than most investors believe.”

Confirming what we have been saying since 2010 when we first explained that it is not the stock but the flow that matters, and that tapering is tightening, Wilson echoes our decade-old conclusion and writes that “tapering is tightening for markets, if not the economy.” And due to the much greater than expected rise in inflation – now that even Powell has killed and buried “team transitory” – the Fed is pivoting to a more aggressive removal of monetary accommodation.

Wilson believes this is warranted and supported by an administration that appears less focused on the stock market as a barometer of

its success (actually since this administration has zero success to “barometer” besides flooding money into the economy and watching inflation skyrocket of course, it simply hasn’t even considered the level of the S&P; it will soon… after the crash).

Furthermore, the Morgan Stanley strategist believes that tapering is different than in 2014 for 3 reasons:

- the Fed is exiting QE twice as fast this time,

- asset prices are much richer today and

- growth is decelerating rather than accelerating.

And as we joked earlier (but not really) with the Fed tapering and soon hiking, the outcome will be a recession and a market crash…

Dear @federalreserve – we all know that your taper/rate hikes will trigger a recession and market crash. Can we just fast forward to NIRP and even more QE that always follow?

— zerohedge (@zerohedge) December 13, 2021

… Wilson again agrees and says that such an adverse market reaction “could be important for the economy, too, given how levered consumers are to stock prices today.”

Taking a more nuanced look at Morgan Stanley’s forecast, Wilson explains that when he was writing his (decidedly bearish) year ahead outlook, he was faced with “a wider than normal range of potential economic and policy outcomes.” This higher ” uncertainty” was one of the key inputs to the bank’s conclusion that valuations for US equity markets were likely to come down over the next 3-6 months, and as further notes explains “in our discussions with hundreds of clients since publishing our outlook, the conversations have centered around how to handicap these various outcomes.” Wilson lists the three scenarios as follows:

- Goldilocks: When we published on November 15, this was the prevailing view by most clients. In this outcome, supply picks up in 1Q to meet the excess demand companies are having a hard time fulfilling. Inflation falls back toward 2-3%, allowing the Fed to move gradually with its taper and hike maybe 1-2 times in 2022, a modest amount of tightening that most believe the economy and markets can handle. Under this scenario, earnings growth is solid (10-15%), interest rates stay well behaved and valuations remain elevated (20-21x Forward EPS). This yields 5-10% upside to the S&P 500 over the next year or roughly 5000. For us, this was the Bull case outcome in our outlook with a 20% probability.

- Inflation remains hot and the Fed responds more aggressively: Under this outcome, inflation proves to be stickier as supply chains and labor shortages remain difficult to fix in the short term. The Fed is forced to taper faster and even raise rates on a more aggressive path than investors expect. This was our base case as it essentially lined up with our hotter but shorter cycle view we first wrote about back in March. Under this outcome, interest rates continue to rise next year to 2-2.25% by year end. At the same time, operating leverage starts to fade as costs increase more in line with revenues, leaving limited margin upside. This leaves breadth narrow in the near term as valuations come down and P/Es finally normalize in line with the traditional mid cycle transition. While there is some debate around how much P/Es need to fall, we believe 18x is the right number to use for year end 2022 and when combined with 10% revenue growth that gives us slight downside to the index from current prices, or 4400. We put a 60% probability on this outcome.

- Supply picks up just as demand fades: Under this outcome, supply does improve but it’s too late to meet what has been an unsustainable level of demand and consumption for many goods. It’s also too expensive for customers who have become more wary of high prices, which leads to discounting and a whiff of deflation for many areas of the goods economy. While services should fare better and keep the economy growing, goods producing companies suffer and make up a much larger part of the consumer discretionary part of the stock market. Under this scenario, the Fed may decide to back off on their more aggressive tightening path. Rates fall but not enough to offset the negative impact on margins and earnings which end up disappointing. This is essentially the “Ice” part of our narrative turning out be colder than expected. Equity risk premiums soar and multiples fall even more than under our base case. This was our bear case with a 20% probability.

Before we drill down into these, a quick detour to Wilson who says that since publishing his year-ahead forecast one month ago, he feels “more confident about our base case being the most likely outcome. Inflation data continues to come in hotter and based on commentary from our analysts, companies seem to be having no problem passing it along to customers, keeping inflation sticky on the upside. While this will likely lead to another good quarter of earnings overall, we suspect there will be more casualties, too, as execution risk is increasing leaving dispersion high and leadership inconsistent — two more conclusions in our outlook.” This means that stock picking, while difficult, will be a necessary condition to generate meaningful returns in 2022 as the market separates the winners and losers and index basically goes nowhere over the next 12 months.

Meanwhile, and far more ominously, Wilson also warns that “the likelihood of our bear case is growing relative to our bull case. As it stands, we would say Bear case is now 30%, Base case is still 60% while goldilocks looks like a distance 3rd at just 10%.”

In other words, the odds that the Fed will short circuit its tightening plans are rising.

* * *

With that in mind, let’s focus some more on Wilson’s core assumptions, at the top of which is that…

The change in the Fed’s reaction function is a big deal because Tapering is Tightening

While Morgan Stanley’s base case has always assumed the Fed would respond appropriately to the higher inflation, “the pivot by Chair Powell at his recent Congressional testimony was more aggressive than what we expected, especially in light of the new Covid variant, which at the time was a known unknown.” We discussed this over the weekend in depth. Here, Wilson concedes that with Omicron now looking like a lower risk to growth than 2 weeks ago, this only raises the probability that the Fed will indeed taper its asset purchases much faster than the last tapering episode in 2014, and Morgan Stanley “economists point out that the Fed is now suggesting stable prices is important to achieving its primary goal of full employment which means inflation has taken center stage, until it’s under control.” In terms of speed, the bank’s forecast is now for the Fed to end its asset purchase program by the end of March, the same as Goldman. However, if the Fed executes on that path, “it will leave a mark on asset prices in our view.”

Wilson also thinks Jay Powell and the Fed will be under much less pressure from the White House versus the last time they tried to take the punch bowl away in late 2018. Part of this is due to the fact that inflation is a much bigger problem today than it was in 2018 and part of it is due to the observation that this White House is not as preoccupied with the stock market. Wilson’s bottom line: “the Fed put still exists but the strike price is much lower now, in our view. If we had to guess, it’s down 20% rather than down 10% unless credit markets or economic data really start to wobble.”

Here Wilson encounters the same challenge we have observed over the years, namely that most disagree with the conclusion that tapering is tightening (for markets, if not the economy). As evidence, those who still don’t understand that only the Flow (and not the Stock) matters, point to the tapering in 2014 as an example of how markets traded well as the Fed let the air out of the balloon back then. On that score, Wilson has makes several points to argue “it could be different this time.”

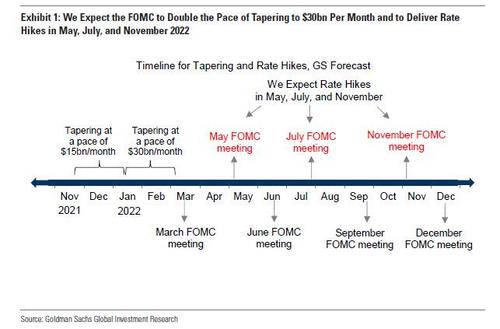

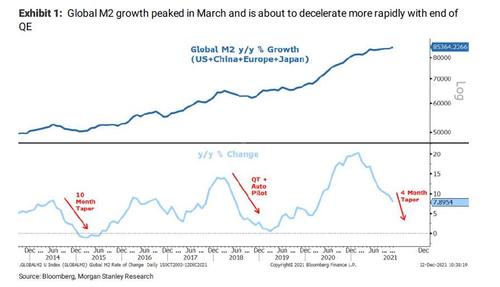

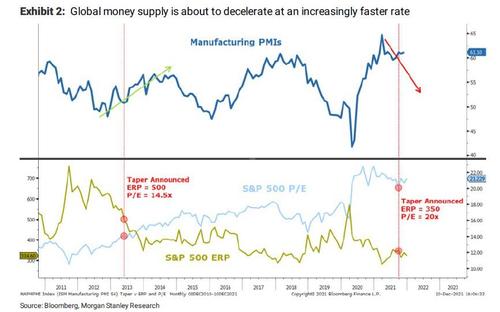

First, in 2014, it took the Fed 10 months to taper its QE program. This time they will do it in just 4 ½ months, or twice as fast. While M2 has been decelerating this year on a global basis, it’s still running almost 8% y/y (Exhibit 1). In the US, M2 growth is running 13% and explains a lot of why nominal GDP growth is also running about 13% in the fourth quarter. After all, MV=PQ. If the Fed takes QE down to zero, its global M2 growth will slow severely and likely fall below 5% by the end of 1Q. This looks a lot like 2014 and 2018, but at a faster pace. Wilson’s guess is that growth will take a hit at a time when it’s already decelerating and increase the odds of our bear case playing out.

Second, US Equity markets are much richer today and therefore more vulnerable to a swift reduction of liquidity. Specifically, the equity risk premium is 350bps today and was close to 500bps when they started the taper talk in 2013. P/Es were 14.5x versus 20x today. To be sure, rates were higher then but that is why multiples had room to rise from there as rates reflected the more hawkish Fed and inflation that was much lower then. As a result, valuations were able to hold in and even increase during that tapering episode.

Third, growth is decelerating now while in 2013-14 it was accelerating. In addition to the PMI shown in the exhibit, earnings and economic growth were accelerating whereas both are likely to decelerate in 2021 and even outright decline for many companies, particularly in the first half of the year when the comparisons are most difficult. This, Wilson says, is what will really separate the winners from the losers and why he is so focused on earnings stability/achievability and valuation “because small beats will likely not be enough to drive stocks higher if they have a premium P/E.”

Morgan Stanley’s bottom line: given that much of the market is expensive relative to history, rather than just a few sectors or names, it suggests to this tapering episode will be different than the last one and is likely to leave the overall market lower than where we are trading today by the end of the first quarter if the Fed goes through with an expedited tapering schedule.

In short, Powell – who was wrong about inflation being transitory for the past year and only two weeks ago admitted he was dead wrong – is about to trigger a nightmare scenario for market, and will scramble to snuff inflation just as it has already peaked, and just as the global economy is sliding into a fast slowdown.

* * *

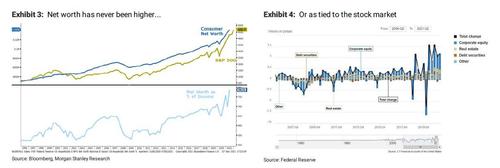

But wait, there’s more because as Wilson also correctly observes, asset markets have never been more important to consumer health. That’s right: a market crash here and we spiral right into a deep recession, perhaps even worse than the Global Financial Crisis.

While Morgan Stanley’s base case is that the economy should be able to handle the ending of QE and even some rate hikes next year, the big risk has always been that if asset markets correct more significantly it could have a greater than normal effect on the economy too given how levered the consumer is to the stock market and other asset prices like housing and crypto currencies. When just considering the stock market, it’s easy to see that consumer net worth has increased dramatically as many key assets have risen inexorably over the past 18 months. And while this is a good thing for consumer demand if prices remain elevated, it also dramatically increases the odds that the inverse will be just as painful, and tapering will quickly become tightening for the economy, too, if it leads to a significant asset price deflation.

Here, Morgan Stanley thinks that “the risk of that is greatest over the next 3-4 months as the Fed exits QE on this faster time table.”

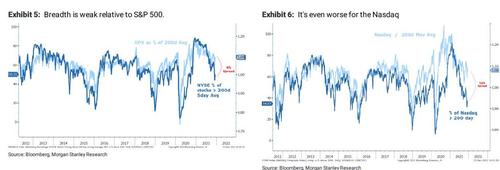

The market has, naturally, been ignoring these risks and one place where this is especially obvious is the collapse in market breadth. Since September, breadth has rarely been this weak relative to the Index level price

As Wilson concludes, “the rolling correction that began last spring continues under the surface, making the index a very bad gauge of the overall health of the stock market, or the economy, in our view.” The good news here is that the average stock has already discounted a good chunk of the risks Morgan Stanley is forecasting “even if the index has not.”

In this regard, the bank continues to stress that watching the S&P 500 is a bad idea for measuring what the market is really telling us about the fundamentals. It also explains why it’s been so difficult for many active managers to keep up with the benchmark. And while the average stock may begin to outperform as the index catches down, Wilson warns that the absolute direction for most stocks will remain lower until the index has taken its turn on the de-rating process that began over 6 months ago. It’s also why Wilson remains overweight large cap defensive quality for now.

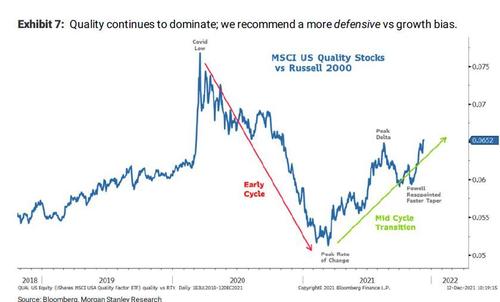

One final point from the MS strategist: if there is one chart that depicts the risk off nature of the markets under the surface, it’s the MSCI large/mid cap quality index versus the Russell 2000 small cap index.

As Wilson concludes, “making this very simple pivot in March as the rate of change on growth and policy peaked was the more important thing to do this year for performance… We continue to recommend this pair but with a more defensive bias on the quality side rather than growth due to valuation constraints as the Fed accelerates its taper this week.”

Via Zerohedge