Despite a populist grassroots movement seeking to ban Congress members from trading stocks, one which has attracted bipartisan political support, Democratic House Speaker Nancy Pelosi – arguably one of the most prolific Congressional traders – said two weeks ago that lawmakers should be allowed to make trades while serving.

“We’re a free market economy,” Pelosi told reporters during a news conference. “They should be able to participate in that.”

Pelosi’s statement came days after progressive New Yorker, Alexandria Ocasio-Cortez, reiterated her support for banning lawmakers from the practice. Ocasio-Cortez and other members of Congress argue that lawmakers have access to information the public is not privy to and the ability to write and pass policy, they should abstain from buying and selling individual stock and other assets. She and other lawmakers support members of Congress investing in index funds.

“I choose not to hold any so I can remain impartial about policy making,” Ocasio-Cortez wrote on Instagram.

Pelosi’s statement also came in the wake of a series of scandals involving federal lawmakers, Fed and government officials making suspect trades throughout the coronavirus pandemic.

Currently, Senator Richard Burr (R-N.C.), is under investigation by the Securities and Exchange Commission for trades he made in the early days of the pandemic (Burr has said all of his trades were based on news reports, not non-public information), and other lawmakers were investigated by the Department of Justice for their trades.

It’s not limited to Congress: In October the Fed announced it would ban officials from owning individual stocks and bonds after two officials – Dallas Fed president Robert Kaplan and Boston Fed president Eric Rosengren – resigned following allegations of insider trading.

Members of Congress are theoretically barred from trading on nonpublic information thanks to the Stop Trading on Congressional Knowledge, or STOCK, Act, and during the press conference, Pelosi noted that lawmakers need to follow that law. “If people aren’t reporting [stock trades], they should be,” she said.

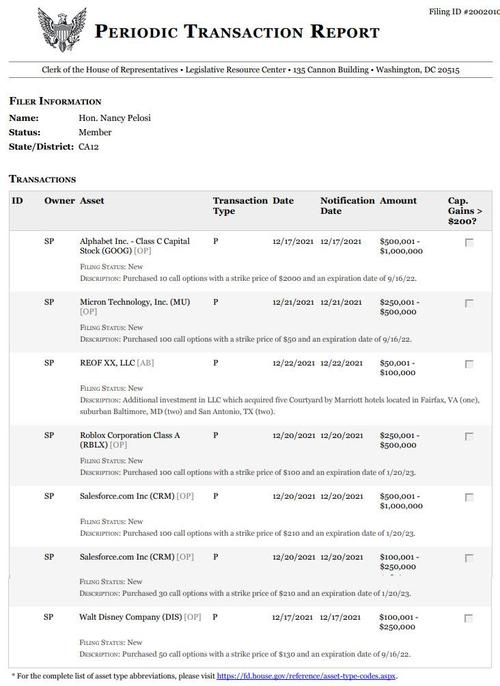

We mention all of this because according to the latest Periodic Transaction Report covering Nancy Pelosi’s latest trades, the California Democrat purchased millions worth of call options in companies from Alphabet, to Micron, to Roblox, Saleforce and Walt Disney. Unfortunately, the strike price of the options was not disclosed, although with maturities well into 2022 and in some cases 2023, this appears to be a long-term levered bet.